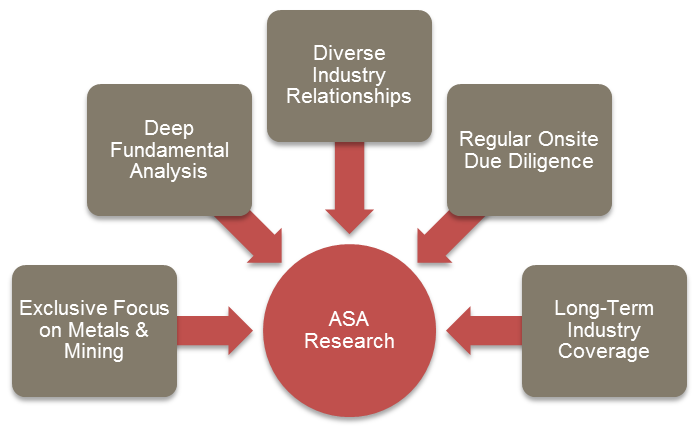

Investment Strategy

ASA Gold & Precious Metals Limited invests in the securities of companies engaged in the mining, processing or exploration of gold, silver, platinum, diamonds and other precious minerals. ASA employs a bottom up fundamental analysis and relies on detailed primary research including meetings with company executives, site visits to key operating assets, and proprietary financial analysis in making its investment decisions. Risk is managed through regional diversification at the asset level and a deep understanding of geopolitical risks. ASA employs a long only concentrated strategy with low turnover.

Fundamental Analysis

The execution of the investment strategy is deeply rooted in our primary research and thorough fundamental bottom-up investment analysis. In order to ascertain a company’s valuation, ASA conducts extensive analysis on each asset, which enables the determination of both absolute and relative valuations. Financial models are built to analyze historical operating performance and to understand future free cash flow potential. Numerous public filings are analyzed along with information gathered through meetings with management, visits to operating assets and conversations with industry and regional experts. Through this modeling, we are able to quickly review our valuations based on updated mining results, acquisitions and other news that may affect a company’s value.

Onsite Due Diligence

Our extensive due diligence process includes hundreds of meetings with company executives and numerous visits to assets annually. The research process helps us identify key trends in the industry and individual companies of interest. Attendance at industry conferences, meetings with managers and operators and networking with industry specialists and other investors helps to identify important drivers or possible setbacks that will influence companies within the industry. A visit to the mine site plays an integral role in the due diligence process. On a mine visit, we evaluate the quality of the operations first-hand and obtain access to mine operators, geologists, contractors and managers who each provide unique insights regarding the opportunities and challenges at the individual operation. This “hands-on” primary information allows ASA to gain an understanding of the operations that goes beyond reviewing the typical marketing presentation. Information gathered through this process is integrated into both the financial model and valuation analysis to support the investment decision.

Diverse Industry Relationships & Long-Term Coverage

Having followed many management teams within the industry for decades, the Company’s investment team believes it has insight in evaluating the strength of leadership at a given issuer. The importance of high quality, experienced management teams is magnified by the cyclical nature of the mining sector, as well as the complexity of managing a mine throughout its life. Put simply, a quality management team can make a successful mine out of a low quality asset, but poor management will often destroy shareholder value regardless of the quality of the asset.

Exclusive Focus on Metals and Mining

The ASA investment team is focused on covering the metals and mining sector. This sector dedication allows us to closely track changes and potentially identify opportunities.

Certain Tax Information: ASA is a “passive foreign investment company” for United States federal income tax purposes. As a result, United States shareholders holding shares in taxable accounts are encouraged to consult their tax advisors regarding the tax consequences of their investment in the Company’s common shares.